Finding the right finance for your business

Helping women find the right finance for their business is our goal and our database of finance providers is – we believe – a unique resource. There are certainly listings of finance sources elsewhere, but none with a specific focus on finance for women-led businesses.

Most providers listed are signatories of the Investing in Women Code. This is a commitment to support finance for women-led businesses. Here is a short introduction to the Code.

How to get the best from the database of providers:

- Start with your location. Most of the providers are UK-wide and will not be affected, this just helps to remove from your search those organisations that focus on a specific area. This is especially the case for e.g. Angel investment, which typically relies on face-to-face meetings.

- If you know the specific type of finance you are seeking, that is the next filter to use. This will return a short enough list of results to be useful. You can select multiple finance types if you need.

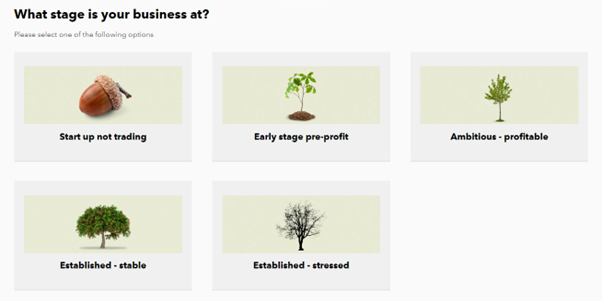

- If you are not yet sure, the business stage filter (start, grow, scale) will show you all relevant providers. You can then use this as a starting-point for your research.

- The entries themselves all include a contact point, so you don’t need to trawl through a website looking for this.

- Before you contact the provider, it is worth looking at the additional links provided with their entry. These will usually give you a feel for what that provider is looking for, sometimes case studies and videos of other women they have financed.

Which type of finance is right for you?

Making the right finance choice is not only about getting the money you need today, but also keeping your future options open. For example, rather than taking out a bank loan to buy equipment, using asset finance from a specialist provider could allow you to keep the option of a loan or overdraft at a later stage to finance working capital.

We’ve shared articles and case studies on the website that show how women have used different forms of finance to start and grow their businesses. For comprehensive insights there are two excellent resources worth looking at, both of which are linked at the foot of the page.

The Business Finance Guide from the ICAEW (Institution of Chartered Accountants for England and Wales) is available both as a publication to download and as a website. By following a simple diagnostic approach, you can home in on the finance option that’s likely to be right for you.

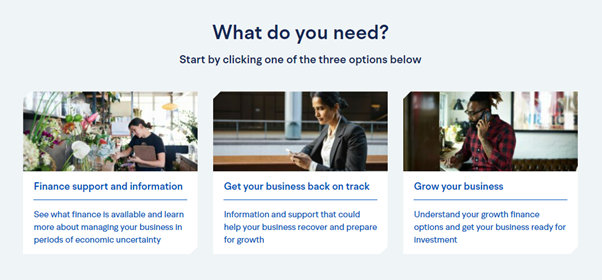

The Finance Hub from the British Business Bank is even more comprehensive, with sections on finance for investment in low-carbon projects such as insulation or heat pumps and a Guide to building business resilience to help businesses manage the challenge of rising costs

Before you apply

These is a wealth of resources available through the Invest in Women Hub to increase your chances of success when applying for finance, whether it is a bank loan, working capital finance or equity investment. This is where a comprehensive business plan will pay dividends, ensuring that you have all of the information to hand that a lender or investor will expect, to back up your application.

Many of the networks we feature offer help with business planning and investment readiness, you can search for these features from the networks page (simply select from ‘services provided’). Simply talking to someone who has been through the application process before can bring useful insights, and reassurance that you are on the right track.